Tax Deduction Time Machine – Retroactive Plan Adoption

Thanks to the SECURE Act, eligible employers can now retroactively adopt a retirement plan for the prior tax year, offering a powerful way to reduce taxes and boost retirement savings.

Other Video Resources

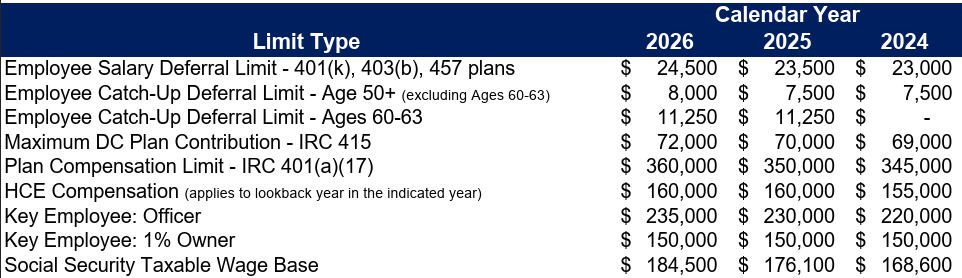

IRS Announces Plan Limits for 2026

On November 13, 2025, the IRS released cost-of-living adjustments for various retirement plan limitations that will take effect on January 1, 2026. We have presented a few of the more important plan limits below. For more information, please contact us at 1-800-594-7700.

The Workplace Retirement Plan Resource

This popular resource for financial professionals and employers concisely dives into popular plan designs, providing sample illustrations. It also summarizes key provisions of the SECURE 2.0 Act, including automatic enrollment and the new plan tax credits.